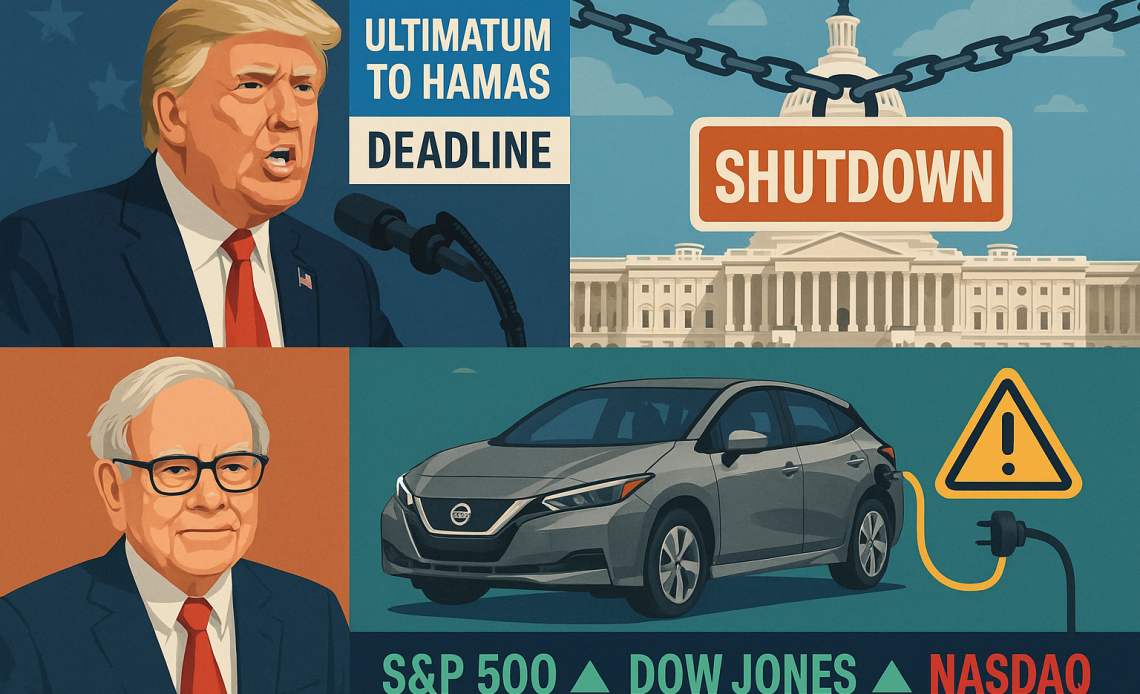

The United States closed the week with a mix of geopolitical tension, domestic political gridlock, and significant corporate developments.

President Donald Trump issued a deadline for Hamas to accept a peace proposal, while Washington’s budget impasse extended the government shutdown.

Meanwhile, Berkshire Hathaway restructured its leadership, Nissan announced a major recall, and the Federal Reserve flagged slowing growth.

Trump sets deadline for Hamas to accept Gaza peace plan

President Donald Trump has given Hamas until Sunday evening to accept his 20-point proposal to end the war in Gaza.

The plan, developed with Israeli Prime Minister Benjamin Netanyahu, requires Hamas to release all hostages and excludes the group from any governing role in Gaza.

In exchange, Israel would release nearly 2,000 prisoners and pledge not to occupy or annex the territory.

Trump warned that if Hamas fails to comply, “all hell” will break out against the group.

Netanyahu has signed the agreement, and Trump claims support from regional allies.

Hamas, however, has yet to issue a formal response, saying it is still consulting with partners in Qatar, Egypt, and Turkey.

The Israel Defense Forces (IDF) accused Hamas of blocking civilian evacuations, while reports suggest nearly 870,000 residents have already left Gaza City amid continued fighting.

US government shutdown stretches on

The federal government shutdown will continue into next week after the Senate rejected both Democratic and Republican funding bills.

The GOP-backed version failed in a 44-54 vote, while the Democratic measure was voted down 46-52, short of the 60-vote threshold.

Republicans insist no deal can be reached while the government remains shut, whereas Democrats are demanding progress on insurance subsidies as part of reopening negotiations.

The impasse adds further strain to public services and raises questions about near-term economic resilience.

Trump to be in 250th anniversary coin

US Treasurer Brandon Beach confirmed that new one-dollar coins featuring President Trump will be issued to mark America’s 250th anniversary in 2026.

Draft designs depict Trump’s portrait alongside the phrase “In God We Trust, 1776–2026,” with the reverse showing Trump raising his fist with the American flag and the words “FIGHT, FIGHT, FIGHT.”

Beach stressed the authenticity of the designs and said more details would be shared once the government shutdown ends.

Berkshire Hathaway splits Chairman and CEO roles

Berkshire Hathaway announced that its Board of Directors has formally separated the roles of chairman and CEO.

The decision, effective immediately, follows a September 30 board vote.

Warren Buffett will remain chairman, while Greg Abel, currently vice-chairman of non-insurance operations, will assume the CEO role beginning January 1, 2026.

The move marks a significant leadership transition for the conglomerate while maintaining Buffett’s influence as board chair.

Fed flags economic slowdown

US Federal Reserve Vice Chair Philip Jefferson reported a slowdown in economic growth during the first half of 2025, with GDP expanding at 1.6%, down from 2.4% in 2024.

Jefferson attributed the decline to weaker consumer spending and warned of inflationary pressures from higher tariffs.

He noted that employment growth has slowed due to softening labor demand and weaker labor supply.

While acknowledging “especially high” uncertainty in the outlook, Jefferson said clarity may improve as White House policies are finalized.

Nissan recalls nearly 20,000 EVs

Nissan North America is recalling 19,077 electric vehicles in the US due to a battery charging defect.

The issue, linked to lithium-ion battery overheating during Level 3 charging, poses a fire risk.

The recall affects certain 2021-2022 LEAF models with a quick charging port.

Dealers will update the battery software free of charge, and owners have been advised not to use Level 3 charging until repairs are made.

US stock markets end mixed

The S&P 500 retreated slightly from record highs but remained on track for weekly gains.

The broad index rose 0.01%, the Dow Jones Industrial Average climbed 0.51%, the Nasdaq Composite fell 0.28%, and the Russell 2000 increased 0.85%.

Declines in major tech stocks like Palantir which fell 7%, Tesla which declined 1.4%, and Nvidia, down almost 1% weighed on afternoon trading.

The CBOE Volatility Index spiked, reflecting heightened investor caution, though weekly performance remains positive.

The post US digest: Trump’s Hamas ultimatum, government shutdown stalemate continues appeared first on Invezz